Presentation

Pied Piper Group is a premier real estate finance organization based in the United States, committed to offering corporations financing solutions that are securely backed by stable real estate assets. It is the vehicle that allows us to construct and operate our multifaceted infrastructure. Pied Piper Group’s core mission is to ensure that everyone has access to affordable housing and the financial resources essential for stability and growth.

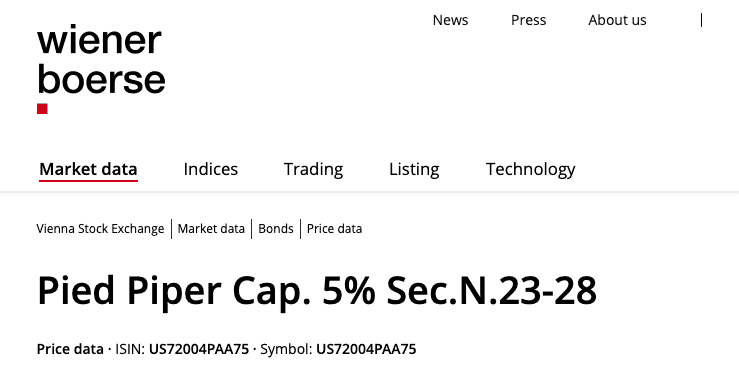

Pied Piper Capital Fund serves as the financial backbone of our organization, providing us with the unique capability to self-finance strategic projects. Our capital, backed by gold and listed on the Vienna Stock Exchange, enables us to fund real estate developments, business investments, and other initiatives that align with Pied Piper Group’s growth and social impact objectives. This financial structure not only ensures stability and accountability but also empowers us to advance high-impact projects that stimulate economic development and contribute to community revitalization. By leveraging our own resources, we align our investment strategy with public interests, creating sustainable value for both our clients and the broader economy.

Our journey began as a response to a complex housing market, where prohibitive costs and limited accessibility formed barriers for many. Determined to disrupt the status quo, we pioneered solutions that address the affordability crisis with a focus on inclusivity and sustainability. Through a balanced, dual-pronged approach that emphasizes both affordability and innovation, we create pathways to accessible housing, sustainable homeownership, and financial freedom. Our vision goes beyond providing homes; we build solid foundations for growth and vibrant communities, empowering our clients to secure stable, lasting futures.

PRODUCTS & SERVICES

Within any real estate financing transaction, there are a multitude of services that are required. As such, Pied Piper Group provides an all-encompassing suite of services under one platform to ensure both the successful completion of the transaction, as well as a quick, seamless, and stress-free experience for our clients. Our revolutionary ecosystem is meticulously designed to cater to every aspect of our clients’ financial and real estate aspirations including: securing funding, navigating the intricate landscape of real estate, spearheading development projects, safeguarding investments with hedge funds, orchestrating insurance coverage, ensuring flawless title services, and more. Pied Piper Group is a one-stop resource dedicated to empowering our clients without crippling their financial independence.

In addition to our focus on housing and affordability, Pied Piper Group champions investors, entrepreneurs, and businesses of all sizes. Our comprehensive service offerings—ranging from business structuring, marketing, and HR to advanced lending and payment processing solutions—support business owners in every phase of their growth.

Residential Real Estate

• Fixed & ARM Loan Products

• Non-QM Loan Solutions

• Non-Agency Jumbo Loan Products

• Emerging Banker Program

• Warehouse Lines of Credit for Lenders

• Piggyback 2nd Combo Loan Products

• Purchase & Lease Loan Products

Commercial Real Estate

• Commercial Mortgages for Acquisition & Refinancing

• Acquisition & Development of High-Rise Apartments

• Cabins, Warehouses, Restaurants, Gas Stations & Churches

• Fix & Flip - Single Family & Multi-Family

• Office Complexes & Retail Spaces

• Multi-Family Commercial

• Bridge & Hard Money Loans

• Stated Income Loans

• Purchase & Lease

Development & Construction

• Development

• Rehabilitation

• Ground Up Construction - Single Family, Multi-Family & Commercial

• Home Builder Financing

• Project Financing

Real Estate Investments

• Direct Ownership of Properties

• Real Estate investment Trusts (REITs)

• Real Estate Crowdfunding

• Private Equity Real Estate Funds

• Real Estate Partnerships or Syndications

Pied Piper Capital Fund

• Direct Ownership of Properties

• Real Estate investment Trusts (REITs)

• Real Estate Crowdfunding

• Private Equity Real Estate Funds

• Real Estate Partnerships or Syndications

Real Estate

• Buy/Sell Residential Real Estate

• Buy/Sell Commercial Real Estate

• Comprehensive Property Listings

• Property Management Services

• Market Analysis and Valuation

• Personalized Services

• Expert Guidance

Business Funding

• Business & Franchise Acquisitions

• Term Loans (3 years or less)

• Equipment Financing & Leasing

• Franchise Financing

• Medical Business Financing

• Mergers & Acquisitions

• Private Equity / Joint Venture

• Consumer Finance

Insurance

• Real Estate Insurance

• Comprehensive Coverage Options

• Customizable Policies

• Discounts and Bundling

• Quick Claims Process

Payment Processing

• Payment gateways

• Online transaction

• Point-of-sale (POS) systems

• Credit card readers

• Ecommerce support

• Check processing

• Gift cards

• Loyalty programs and promotions

• Partner networks

TECHNOLOGY

-

Pied Piper Group leverages advanced, cutting-edge technology to deliver customized solutions and streamline client experiences. Our robust and integrated digital infrastructure, encompassing a seamless onboarding system, mobile app, sophisticated ERP system and operational platforms, support the full spectrum of services—from origination and underwriting to insurance, real estate, development, and comprehensive operational support. This strategic technological foundation, which is backed by 24/7 support and state-of-the-art security, firmly establishes Pied Piper Group as an industry leader, enabling us to offer swift, secure, and versatile solutions that empower our clients with unparalleled access to a wide array of financial options.

Combines familiar applications like Word, Excel, and PowerPoint with cloud-based services, enabling real-time collaboration and boosting productivity across teams, regardless of location.

Provides robust security measures, including advanced threat protection, multi-factor authentication, and data loss prevention, ensuring sensitive information is safeguarded.

OneDrive and SharePoint offer ample storage and easy access to files from any device, enabling remote work and improving operational efficiency.

The suite offers scalable solutions tailored to fit our organization’s requirements.

Enables us to manage the entire client lifecycle, from acquisition to onboarding and ongoing client support, in one unified platform.

With features like document sharing, task tracking, and real-time communication, it makes it easy for our teams to collaborate internally, with clients, vendors, and partners effectively and efficiently.

Customizable workflows that automate routine tasks, helping save time, reduce errors, and ensure consistency across projects.

Client portals provide a centralized space for our clients to track progress, exchange information, and receive updates, which enhances transparency and strengthens relationships.

Built with enterprise-grade security, it ensures data privacy and helps our organization meet regulatory requirements.

Provides access to vast amounts of public records and proprietary data sources, helping us gather critical information on individuals, businesses, and assets.

Its robust search tools allows us to quickly locate and verify information, filter data by specific criteria, and uncover connections that may otherwise go unnoticed.

Supports our organization in maintaining compliance with regulatory requirements by facilitating thorough background checks and due diligence.

The platform offers real-time alerts and monitoring, enabling us to stay updated on key changes and emerging risks related to people and entities of interest.

Is designed with an intuitive interface, making it easy to navigate, interpret data, and generate detailed reports efficiently.

Allows us to connect with clients’ bank accounts, no matter where they bank, through secure API connections, maintaining high standards for data privacy and security. Has extensive data connections and the capability to verify depository accounts from any U.S. bank.

By enabling direct account connections, it simplifies onboarding, reduces friction, and enhances the client experience.

Provides access to real-time financial data, such as transaction history and account balances, enabling us to make informed decisions and provide better services.

Allows us to verify good clients and stop bad ones in seconds by going beyond basic KYC compliance and analyzing hundreds of risk signals to prevent identity theft, synthetic ID fraud, and account takeovers.

Prevents account takeovers during onboarding or when the source of funds is switched. With identity verification we can verify bank account details to confirm source of funds or understand payer and payee risk.

The /identity/get and /identity/match endpoints allow us to retrieve various account holder information on file with the financial institution and assess how well it matches against the information the client has provided. This information includes names, phone numbers, addresses, and emails.

Leverages AI-driven technology to automate underwriting tasks, significantly reducing manual workloads and accelerating loan evaluations.

Provides up-to-date market data and property analysis, empowering us to make well-informed decisions based on current trends and property conditions.

With continuous monitoring capabilities, it enables us to track the performance of loans and quickly identify potential risks, ensuring proactive portfolio management.

Consolidates all relevant information in one dashboard, making it easy for our teams to access property data, financial metrics, and loan details in a single place.

By automating data collection and analysis, it reduces errors, improves data accuracy, and increases overall operational efficiency for our teams.

Provides us with detailed and customizable credit reports, enabling us to assess the creditworthiness of potential clients and partners accurately. This helps mitigate risks associated with extending credit or engaging in new business relationships.

It provides advanced risk assessment tools that help our organization identify potential financial risks before they escalate. By analyzing credit scores and trends, we can make informed decisions that protect the financial interests of our organization.

It streamlines the collections process by offering tools to track outstanding invoices, manage communication with debtors, and automate reminders.

Is tailored to meet the specific needs of different our organization, allowing for customized workflows, reporting, and user access. This flexibility ensures that our teams can work in a manner that suits the organization’s operational style.

It helps our organization stay compliant with relevant credit reporting regulations, reducing the risk of legal issues and enhancing the credibility of the organization in the marketplace.

Covers the entire loan lifecycle, providing a comprehensive solution for our organization, including direct access to investors and pricing engine.

The platform allows us to configure workflows that align with our unique processes, helping our teams work more efficiently and reduce processing times.

Includes built-in CRM functionality and communication tools, enabling seamless client interactions, document sharing, and automated follow-ups for improved client experience.

The advanced reporting features offer valuable insights into loan performance, helping us monitor progress, manage risk, and make data-driven decisions.

Ensures that all loan data is handled securely, with tools to help us meet industry compliance requirements.

The system automates all calculations, significantly reducing the risk of errors and ensuring accurate financial reporting.

Provides clear visibility into payment statuses, allowing us to easily identify who is current on payments and who may be falling behind.

It generates high-quality statements, notices, and letters, enhancing communication with borrowers and reinforcing a professional image.

Serves as an ideal solution for various lending sectors, including commercial and real estate loans, and can be adapted for specific business needs.

Features detailed accounting functions that can accommodate virtually any business model, providing flexibility for diverse our organizational requirements.

With its modern interface and capabilities, it offers a state-of-the-art solution that enhances our operational efficiency and improves client service.

Provides a large selection of integrated applications including finance, sales, inventory, project management, human resources, and more. This integration enables our organization to manage all aspects of internal operations within a single platform, reducing silos and enhancing overall performance.

The platform is highly customizable, allowing us to tailor workflows, modules, and user interfaces to meet our organization’s specific needs.

Provides access to real-time data analytics and reporting tools. This enables informed decision-making by providing insights into key performance indicators (KPIs), sales trends, and financial health.

Is designed to grow with the organization, offering the ability to add new modules and features as business needs evolve.

Its automation features streamlines repetitive tasks, reduces manual work, minimizes errors, and enhances overall productivity.

Its intuitive and modern user interface simplifies navigation and enhances the user experience. This ease of use encourages team adoption and reduces training time for new employees.

Has a centralized hub for managing multiple projects, allowing our teams to collaborate seamlessly, track project timelines, budgets, and tasks in one place, which reduces the chances of miscommunication and enhances accountability.

Includes tools for managing client communications and relationships, enabling us to maintain a professional image and keep clients informed throughout the project lifecycle. Features like customizable proposals and invoicing help improve client engagement and satisfaction.

Enables us to manage our resources effectively, from subcontractors to materials. We can assign tasks, monitor progress, and allocate resources efficiently, ensuring that projects stay on schedule and within budget.

The integrated budgeting and financial tracking tools give us the ability to monitor expenses, create accurate estimates, and streamline invoicing processes. This financial oversight helps ensure projects are profitable and reduces the likelihood of cost overruns.

Provides an organized space for storing and sharing important project documents, plans, and designs. This ensures that our team members have access to the latest information and eliminates confusion over document versions.

The mobile app allows team members to access project information and communicate with clients and colleagues on the go. This flexibility supports remote work and enhances collaboration in the field.

Brings together essential tools for managing policies, clients, and renewals, helping our agency maintain a well-organized and efficient workflow.

Provides built-in CRM and marketing automation, enabling our agency to automate follow-ups and enhance client engagement to drive growth.

The platform provides multi-carrier quoting and rating, allowing our agents to quickly generate quotes from various insurers, saving time and improving the excellent client experience.

Its robust reporting tools provide insights into agency performance, helping management make data-driven decisions and track key metrics.

With client portals and mobile access, clients can view policies, request changes, and access documents, improving client satisfaction and reducing administrative workload.

Simplifies the transaction process from listing to closing, allowing our agents to manage documents, track deals, and stay organized within a single platform.

Its powerful CRM and marketing features, enables our brokerages to manage client relationships, automate follow-ups, and run targeted marketing campaigns, all in one place.

Ensures compliance with industry regulations by providing secure document storage, electronic signatures, and audit trails, helping our brokerage maintain accurate records.

The detailed reporting capabilities gives management valuable insights into performance and the ability to monitor key metrics and make data-driven decisions to optimize operations.

Is designed to adapt to the unique needs of our brokerage, making it a scalable solution that grows with the organization.

INNOVATION WITH PURPOSE

MISSION, VISION & VALUES

- MISSION

- VISION

- VALUES

Our mission is to tackle the housing affordability crisis by providing well-designed, energy-efficient, and cost-effective housing opportunities for individuals and families across all income levels. We aim to pioneer a new era of housing equity, where every individual has access to safe, affordable, and sustainable homes. Through our innovative approach to affordable housing and pioneering Rent-to-Own programs, we bridge the gap between aspiration and achievement, ensuring that every individual, regardless of circumstance, has the opportunity to build a secure future and thrive within vibrant communities.

Our vision is to revolutionize the concept of housing, creating affordable housing solutions that prioritize quality, sustainability, and community. We strive to transform housing aspirations into tangible realities.

Innovation, Integrity, Community Focus, Sustainability. Our values form the bedrock of everything we do. Affordable housing isn’t just a basic necessity to us; it’s a fundamental human right, and we’re determined to make it accessible to all. Grounded in our unwavering commitment to affordability, innovation, and inclusivity, we empower individuals and families to thrive, fostering communities where diversity prospers, and every voice is heard. Accessibility, sustainability, and empowerment is what guides us as we redefine the boundaries of possibility in the pursuit of a more equitable and vibrant future for all.

BUSINESS STRUCTURE

Pied Piper Group operates as a multifaceted financial organization offering a comprehensive suite of services to individuals, businesses, and investors. Our structure is designed to maximize operational efficiency and leverage specialized expertise across various sectors, allowing each subsidiary to focus on its core competencies while contributing to the overarching mission of Pied Piper Group. Below is an overview of the companies within our organization and the systems that support our seamless, client-centric operations.

Corporate Services

-

-

Odoo ERP

Used for enterprise resource planning and corporate service management.

-

Microsoft 365

Facilitates corporate operations including email, document storage, IT security, and policy management.

-

Pied Piper Group App

Facilitates corporate operations including email, document storage, IT security, and policy management.

Mortgage Banking & Underwriting

-

-

Blooma

Handles loan underwriting, monitoring, and servicing, allowing for a streamlined loan lifecycle.

-

LendingWise

White labeled proprietary loan origination system that aligns with Pied Piper’s processes. It supports broker onboarding, offering an additional revenue source.

-

Thomson Reuters® CLEAR

Utilized to verify and evaluate investment opportunities, conducting due diligence and minimizing risk.

-

Plaid

Provides identity and asset verification, ensuring secure and compliant transactions by linking to financial data and verifying customer information.

-

Credit Reporting

CIC reduce financial risks, and improve overall efficiency, ultimately contributing to better decision-making and improved financial health.

-

Moneylender

Loan servicing software used to efficiently manage the administration of loans, including tracking payments, managing borrower accounts, and generating financial reports.

Insurance Services

-

-

EZLynx®

A powerful cloud-based insurance software solution designed to enhance operational efficiency across the entire client lifecycle. It provides industry-leading tools to streamline processes, simplify policy management, and elevate client experience.

Real Estate Development & Construction

-

-

Houzz Pro

A SaaS platform that provides project management, estimates and proposals, invoicing and payments, communication, mood boards and a 3D floor planner with various views, marketing and directory placement.

Real Estate Services

-

-

Total Brokerage

Comprehensive platform for real estate sales and management, designed to streamline operations, boost agent recruitment and retention, and drive unparalleled growth.

Investment & Capital Provision

-

-

Odoo ERP

Used for enterprise resource planning and corporate service management.

Pied Piper Group is at the forefront of the digital revolution, reshaping the real estate financial sector with a focus on client-centric values and seamless experiences. Our services deliver agile, tech-driven, and scalable solutions to support our clients’ wealth-building goals through lucrative real estate opportunities. With a strong presence across both developed and emerging markets, we foster a global network of investors and businesses to advance our clients' interests.

Despite the heightened pace of innovation, we remain grounded in family-oriented values, viewing clients as partners in a shared journey rather than as mere accounts that reap profits. We strive to understand their goals and transform their ambitions into high-return investments. We firmly believe that meaningful client relationships are the foundation of successful execution, and our dedication to exceptional customer service sets us apart. Our market differentiation is rooted in providing client-centric services with an engaging attitude, unwavering support, and meticulous attention to each client’s unique needs.

We strive to be a true financial partner for our clients where we make our decisions based on what benefits our clients the most and allow them to share in the profits generated from their business with us.

Our comprehensive and easy-to-use mobile app provides users with 24/7 access and support to ensure full transparency and ease throughout the entire process. It also provides them access to a variety of services and resources allowing them to manage all of their financial, insurance, real estate, development, and merchant processing needs in one place.

We prioritize the security of our users' personal and financial information, using state-of-the-art encryption and multi-factor authentication to keep their accounts safe.

We offer personalized financial management tools that help users manage their money, set financial goals, and track their progress.

Our digital infrastructure's automated process offers a quick, efficient, and seamless onboarding experience, allowing us to service clients much faster.

We use cutting-edge technology to understand our clients' financial needs and provide a personalized experience through tailored services and recommendations, as well as providing them with business operational support to ensure the prosperity of their businesses.

STRATEGIC OBJECTIVES

GROWTH STRATEGY

To achieve sustained, scalable growth by expanding our service offerings, enhancing client engagement, and increasing our market presence across diverse geographies. Pied Piper Group aims to establish itself as a market leader by pursuing a strategy built on diversification, innovation, and strategic partnerships.

Market Diversification & Expansion

Strengthen our foothold in existing U.S. markets by opening additional offices in high-potential metropolitan and underserved regions. Focus on major cities and growing suburban areas where demand for comprehensive financial services is strong.

Identify high-growth international markets, particularly in emerging economies where financial services are rapidly developing. Initiate expansion into key regions in Latin America, Southeast Asia, and Europe, beginning with strategic partnerships with local firms to understand regional demands, establish brand presence, and navigate regulatory requirements. Tailor services to address local needs, such as affordable housing finance and accessible investment products.

Pursue acquisitions of complementary businesses to broaden our service capabilities and client base. Focus on companies that align with our core services. Develop strategic partnerships with fintech companies, real estate developers, and local financial institutions to enhance our offerings, expand distribution channels, and accelerate market entry.

Innovation & Digital Transformation

Continue to invest in the development of our technological infrastructure which integrates all of Pied Piper Group’s services, allowing clients to manage their finances, process payments, explore real estate opportunities, and track investments in a single, seamless interface. Incorporate AI and machine learning to provide personalized insights, automated investment recommendations, and predictive financial planning tools.

Adopt fintech solutions to improve service delivery, optimize operational efficiencies, and create digital products such as mobile banking, online trading platforms, and blockchain-enabled payment processing. Develop digital wallets and embedded finance options, enabling clients to transact and invest seamlessly, while expanding our reach to tech-savvy clients and underserved segments.

Utilize big data analytics to gain insights into client behavior, market trends, and emerging opportunities. Implement predictive analytics to inform decision-making across asset management, investment strategies, and real estate development. Build a data-driven culture that empowers employees to make informed, client-focused decisions, thereby enhancing customer satisfaction and retention.

Client-Centric Growth & Personalization

Continue to leverage technology to create hyper-personalized client experiences, from tailored investment portfolios to customized insurance products. Develop a client advisory framework that allows us to better understand individual needs and deliver solutions that adapt to clients’ changing financial goals and circumstances.

Continue to develop and perfect our a customer service infrastructure, ensure 24/7 support, both online and through dedicated relationship managers. Continue to enhance our robust CRM system to ensure timely and personalized communication, fostering deeper client relationships and improving retention. Encourage a culture of proactive engagement, where client needs are anticipated and addressed before they arise.

Create loyalty programs that incentivize long-term relationships and cross-service engagement. For example, clients who use multiple services (e.g., insurance, real estate, and asset management) could receive discounted fees, early access to new investment opportunities, or preferential terms on loans and merchant processing. Establish rewards that reinforce client loyalty and drive repeat business.

Diversified Revenue Streams

Grow our real estate division by increasing investments in high-demand property types such as affordable housing, commercial properties, and sustainable developments. Position Pied Piper Group as a leader in socially responsible real estate projects that meet market demand and deliver high returns. Consider forming a Real Estate Investment Trust (REIT) to attract additional capital and diversify our investment portfolio.

Develop a portfolio of alternative investment products, including venture capital funds, private equity, and cryptocurrency assets, to attract a broader client base seeking high-growth opportunities. Offer unique investment options that appeal to sophisticated investors and younger demographics, who are increasingly interested in alternative asset classes.

Build out a suite of ESG-focused products, including green bonds, sustainable development loans, and impact investment funds. Appeal to socially conscious investors by integrating sustainability into our investment approach, allowing clients to align their financial goals with their values. Differentiate our brand by promoting a strong commitment to responsible, ethical, and sustainable growth.

Brand Building and Market Positioning

Position Pied Piper Group as a thought leader in the financial services industry through content marketing, research publications, and participation in industry events. Establish a research arm that publishes insights on market trends, investment strategies, and real estate developments, solidifying our reputation as a trusted resource for financial knowledge.

Implement a segmented marketing strategy that uses data analytics to identify and target high-value client segments. Develop marketing campaigns that address the unique needs of different demographics, such as young professionals, retirees, small business owners, and institutional investors. Use digital marketing, social media, and influencer partnerships to expand our reach and engage new clients.

Enhance our brand by building a strong CSR program that focuses on community empowerment, financial literacy, and sustainable development. Actively engage in philanthropic activities, such as sponsoring financial education initiatives and affordable housing projects. Use CSR initiatives to attract socially conscious clients and reinforce Pied Piper Group’s commitment to positive community impact.

Operational Efficiency and Scalability

Adopt advanced automation tools to streamline operations, reduce costs, and improve efficiency across all business units. Implement robotic process automation (RPA) for routine tasks such as loan processing, claims management, and client onboarding. This will enable us to scale operations quickly while maintaining quality and control.

Implement an agile organizational structure that allows for quick adaptation to market changes, rapid deployment of new products, and fast response to client needs. Encourage cross-functional collaboration between teams, fostering a culture of innovation and continuous improvement.

Attract top talent by offering competitive benefits, ongoing professional development, and a culture of inclusion and innovation. Focus on hiring professionals with expertise in emerging technologies, data science, and sustainable finance. Develop a robust training and development program to ensure that employees are equipped with the skills needed to support our growth ambitions.

OUR COMMITMENT

Together We Build a Brighter Future

Our commitment extends far beyond mere business objectives; it’s rooted in a deep-seated belief in social responsibility and sustainable community development.

- Affordability: We're dedicated to making homeownership achievable for all.

- Innovation & Quality: We embrace innovation to deliver high-quality, sustainable housing solutions.

- Empowering Partnerships: We collaborate with communities, stakeholders, and individuals to create meaningful change.

- Community-Centric Values: We believe in the power of collaboration, empathy, and inclusivity to drive positive change.

OUR IMPACT

Revolutionizing Tomorrow, Starting Today

Pied Piper Group is dedicated to making a lasting impact on the communities we serve. Our strategic partnerships with local organizations, government agencies, and community leaders, enables us to extend our reach and help address broader social and economic challenges. Through our innovative approaches in two vital sectors—affordable housing and rent-to-own programs—we strive to empower individuals, families, and communities to achieve stability, security, and a brighter future.

Improved Quality of Life

Enhanced Economic Stability & Growth

Promotion of Social Inclusion & Community Cohesion

Job Creation

Reduced Poverty & Homelessness

Environmental Sustainability Through Eco-Friendly Practices

Homeownership Opportunities

Community Development

Creation of Interconnected Communities where individuals can flourish.

OVERVIEW OF THE HOUSING CRISIS

The housing crisis is one of the most pressing challenges of our time, affecting millions of individuals and families worldwide. Despite economic growth and urban development, the gap between housing demand and supply continues to widen, particularly in urban areas. In this slide, we'll delve into the key factors contributing to the housing crisis and the urgent need for sustainable solutions.

Current Issues

- 1. Rising Housing Costs

- 2. Limited Affordable Housing Stock

- 3. Homelessness and housing Insecurity

- 4. Economic Stability

- 5. Social Inequality

1. Rising Housing Costs

Affordability Gap:

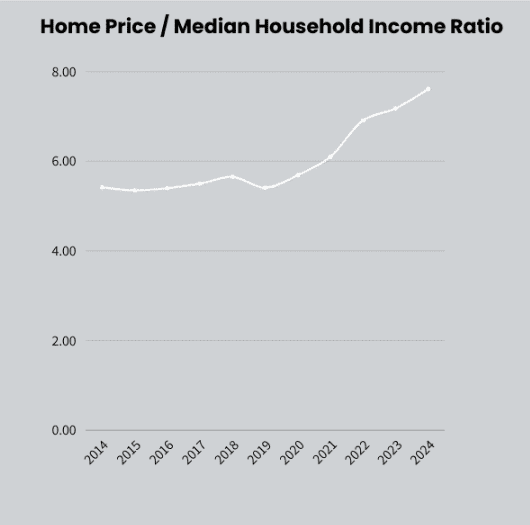

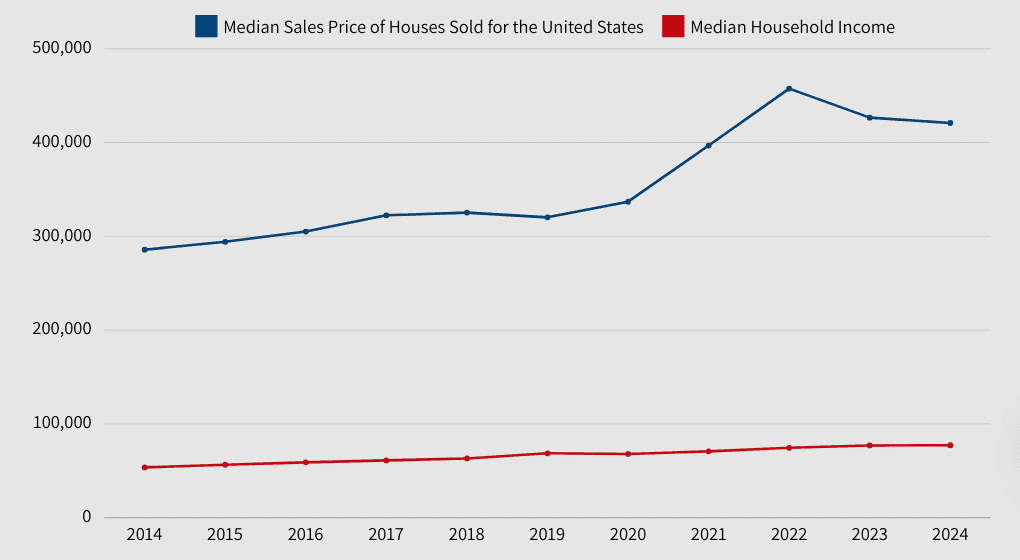

Over the past decade, the cost of housing has significantly outpaced income growth, creating a substantial affordability gab. this has left families struggling to afford adequate housing

Housing prices have increased by 50%, while median incomes have only risen by 20% over the past decade.

Homeownership Barriers:

Homeownership rates have been decling across various demographics, particularly among younger generations and minority groups. Several factors contribute to this trend, including rising home prices, stagnant wage growth, and increased student loan debt.

- Millennials: Homeownership among millennials is lower than that of previous generations at the same age.

- Racial Disparities: Homeownership rates among African, Americans, and Hispanics are significantly lower than those of white Americans.

- Geographic Disparities: Urban Areas, where housing costs are typically higher, see lower homeownership rates compared to rural areas.

Homeownership among millennials is 8% lower.

The Homeownership rate for white Americans was 74.5 %, compared to 44.1% for African, Americans, and 48.8% for Hispanics.

Homeownership rates in urban areas are about 10% lower than in rural areas.

2. Limited affordable housing stock

Supply Shortage:

There is a significant gab between the number of affordable housing units available housing units available and the number of households in need of such housing. This shortage is particulary acute for extremely low-income renters.

Factors contributing to the shortage include insufficient new construction, loss of existing affordable units due to gentrification or deterioration, and the increasing cost of land and construction materials.

Nationally, there is a shortage of over 7m affordable and available rental Homes for extremely low-income renters

100 extremely low _income renter households,there are only 34 affordable and available rent Homes

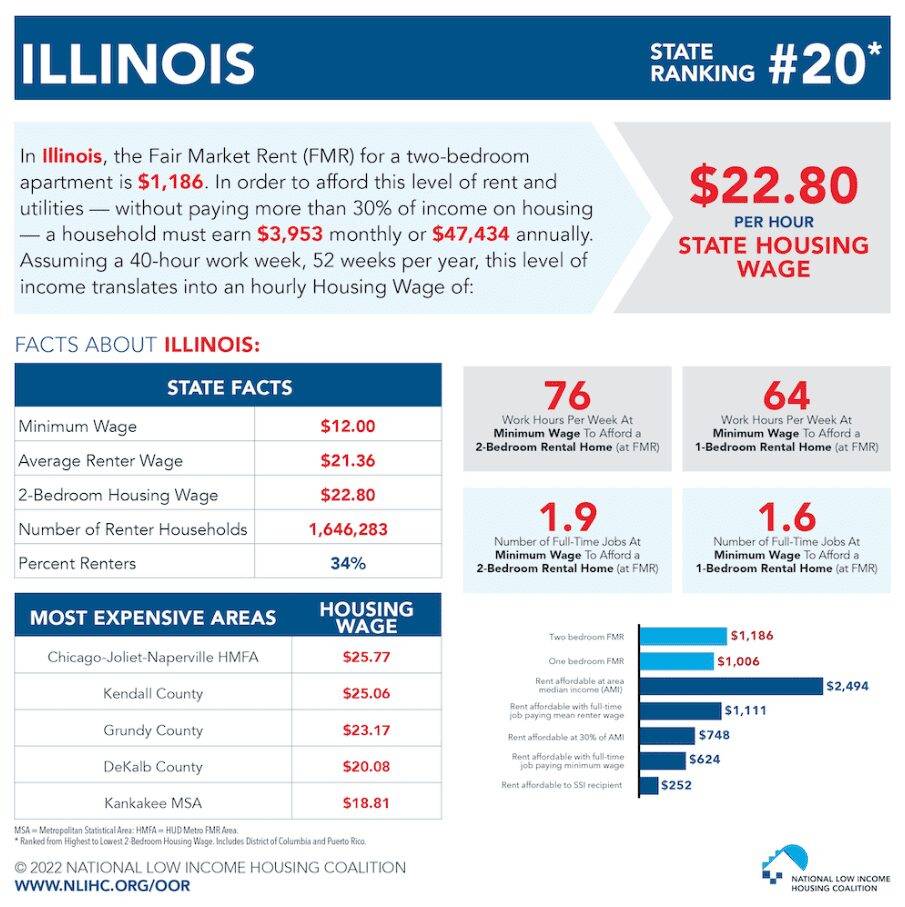

Rent Burden:

A significant portion of renters spend a large percentage of their income on rent, leaving less money available for other essentials such as food, healthcare, and education.

Supply shortgage faces many low-income families to compete for a limited number of affordable units, often leading to overcrowding, long waiting lists for housing assistance, and increased homelessness.

Familes unable to find affordable housing may have to live in substandard conditions or unsafe neighborhoods, which can have long-term negative effects on health, education, and overall well-being.

Over 30% of renters spend more than half of their income on housing, classifying them as severely rent-burdened.

3. Homelessness and housing insecurity

Homelessness:

The Lack of affordable housing is a primary driver of homelessness, affecting hundreds of thousands of individuals and families.

On any given night, over 500,000 people in the United States experience homelessness.

Types of homelessness:

- Chronic Homelessness: Long-term or repeated homelessness, often involving individuals with significant health issues.

- Transitional Homelessness: Temporary homelessness due to sudden life changes such as job loss, eviction, or family breakup.

Consequences:

- Health Risks: Homeless individuals face higher risks of physical illness, mental health issues, and substance abuse.

- Educational Impact: Homeless children experience disruptions in education, affecting their academic performance and future opportunities.

4. Economic Stability

Financial Strain on Families:

High housing costs force families to allocate a large portion of their income to rent or mortgage payments, leaving little for other necessities like food, healthcare, and education.

Families spending more than 30% of their income on housing are less likely to have funds for emergency expenses, increasing their financial vulnerability and are considered cost-burdened.

Sacrifices and Trade-Offs:

- Healthcare: Families may forgo medical care or insurance to afford housing.

- Nutrition: Hight housing costs often lead to food insecurity as families cut back on groceries.

- Savings and Investment: Limited disposable income reduces the ability to save for emergencies, retirement, or educational investments.

Community Impact:

- Local Economies: Reduced spending power affects local businesses and services.

- Increased Public Assistance: Greater demand for social services and housing assistance programs strains public resources.

5. Social Inequality

Disparities in Housing Access:

Affordable housing shortages disproportionately affect marginalized communities, including low-income families, racial minorities, and people with disabilities.

African American and Hispanic families face higher rates of housing instability and are more likely to live in substandard housing

Concentration of Poverty:

- Segregation by income and race often leads to concentrated areas of poverty with limited access to quality education, healthcare, and employment opportunities.

Intergenerational Effects:

Children growing up in unstable housing conditions are more likely to experience long-term socio-economic disadvantages.

- Educational Barriers: Frequent moves and school changes hinder academic achievement.

- Health Outcomes: Pooer Living conditions contribute to chronic health issues, impacting long-term well-being.

OUR SOLUTIONS

1. Holistic Development Strategy

- Integrated Community Planning:

- Develop affordable housing that includes essential amenties like schools, healthcare facilites, and retails spaces to create self-sustaining communities.

- Sustainable Building Practices:

- Use eco-friendly materials and enery-efficient designs to reduce construction costs and long-term living expenses.

2. Partnerships and Collaborations

- Public-Private Partnerships (PPPs):

- Collaborate with governemnt entities, non-profits, and private investors to leverage resources and expertise.

- Example: Partnering with local governments to utilize public land for affordable housing projects.

- Community Involvement:

- Engage local communities in the planning process to ensure developments meet the specific needs of residents.

- Example: holding town hall meetings and workshops to gather input from future residents and community leaders.

OUR SOLUTIONS

3. Innovative Financing Models

- Affordable Financing options:

- Provide low-interest loans and mortgage assistance programs to help low-income families purchase homes.

- Self Fund The Purchase & Renovation of Homes:

- Utilize our own funding to purchase properties, renovate them in order to help increase the affordable housing inventory.

- Tax Incentives and Subsidies:

- Utilize federal and stable tax credits, grants, and subsidies to reduce development costs and make housing more affordable.

4. Job Creation

ECONOMIC BOOST THROUGH CONSTRUCTION

- Direct Employment Opportunities:

- The development of affordblae housing projects directly creates jobs in the construction industry, including roles for architects, engineers, laborers, and project managers. Asingle large-scale housing project can generate hundres of construction jobs, contributing to the local economy.

- Indirect Employment:

- The constuction phase also stimulates job growth in related industries, such as manufacturing (building materials), transportation and retail (supply stores).

LONG_TERM EMPLOYMENT THROUGH COMMUNITY DEVELOPMENT

- Ongoing Maintenance and Operations:

- Once affordable housing units are completed, they require ongoing maintenance and management, creating long-term job opportunities for property managers, maintenance workers, and support staff.

PIED PIPER CAPITAL FUND LLC OVERVIEW

Net Worth

$2,900,000,000.00

Trading Funds

$150,000,000.00

Investment Funds

$1,850,000,000.00 Available

Services Offered

In-House Financing & Insurance

CURRENT PROPERTIES

Owned By Pied Piper Capital Fund

The Pied Piper Capital Fund LLC bond issuance is a Senior Secured Note which is backed by all the assets owned, pledged, and to be acquired by the Issuer and its subsidiaries.

Security/Collateral of the Pied Piper Capital Fund LLC bond issuance.